Barbells Again Doing Heavy Lifting in Muni Bond Portfolios

The balance of 2024 holds much uncertainty for bond investors.

The interest rate path will largely hang on every utterance from the Federal Reserve, each economic and inflation print, and the outlook for the persistently strong labor market. Plus, election year politics (perceived or otherwise) can’t be discounted.

Within the muni bond market, which takes its cues from the broader environment, swings in yield will also follow, but the moves will likely be fairly subdued, especially relative to the volatility of 2022-23.

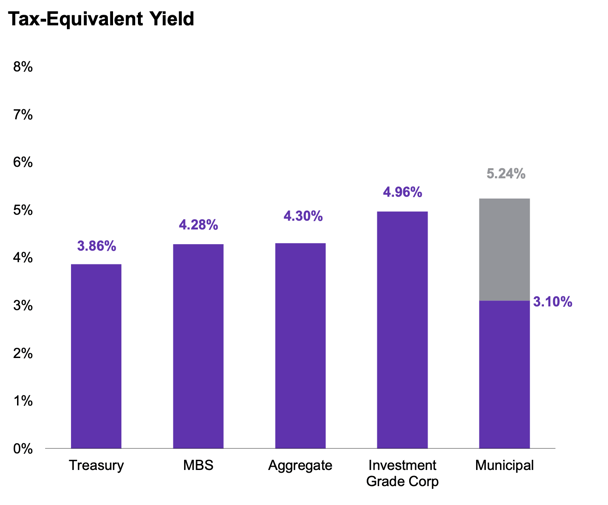

We’re characterizing it as a reasonable environment. With taxable equivalent yields generally falling between 5% and into the 6%-plus range, munis are worth considering as part of a well-diversified portfolio.

Source: Morgan Stanley Monthly Market Monitor, February 2023

The Barbell Workout to Strengthen Returns

Amid the broader unknowns, but with yields at both the short and long ends of the yield curve expected to remain fairly robust, the barbell is back in vogue for muni bond portfolio construction.

Investors with longer-term horizons may recall that through much of 2022 and 2023, barbell strategies seemed the most prudent to generate solid returns.

That is, with short-term yields anchored by the persistently higher Fed Funds rate, including bonds with maturities of two years or less offered elevated yields and near-term flexibility to adjust to evolving market realities. Meanwhile, muni bonds longer than 10 years, which typically don’t see as much retail investor demand, offered compelling incremental additional yield for each year of extended maturity, as well as attractive taxable-equivalent yield.

Outside of a brief stretch in the fall of 2023 when the broader market slumped and pushed rates higher along the entire yield curve, intermediate bonds were less attractive on a relative value basis.

The barbell strategy is attractive again for 2024. Owning better-yielding bonds at the long end provides the opportunity to lock in appealing taxable-equivalents while relatively higher yields at the short end will allow for flexibility. As they roll off, it’s the investors choice to whether to continue to renew positions in short-term bonds or to plug into something else if conditions have changed.

SMA: For Real or In Name Only?

As muni bond yields climbed over the past couple of years, so, too, has the profile of separately managed accounts (SMAs).

Long relegated to a quiet corner of the muni market universe, an estimated 25%-30% of the $4 trillion asset class is presently invested through SMAs, which offers investors the opportunity for customization, transparency, control, tax efficiency and professional management.

In some situations, “big box” managers offer portfolios that are technically in an SMA format yet have debatable correlation with client investment objectives. Perhaps they are too big to focus attention on the goals and parameters for each portfolio?

Having reviewed many portfolios from advisors and prospective clients, we’ve seen the ways some SMA’s fall short. For example, an investor in Florida, where there’s no personal income tax generally should not own bonds from high-tax-rate states such as New York, New Jersey, California, and Connecticut, where bonds trade at a premium due to in-state demand. Allocating to these states unnecessarily could have a detrimental impact on overall portfolio yields.

Situations like this are easily avoidable when the SMA manager is engaged with client investment objectives. If you’re paying for SMA advantages, make sure your portfolio realizes the benefits.

Otherwise, Relatively Benign Dynamics

We don’t believe the rate environment will impact issuance for much of the year. Sure, there could be a bit of a spike if rates move lower or, likewise, some projects put on hold if there’s a jump in rates.

But for the most part, the states, counties, and municipalities that need to issue bonds will do so. It’s rarely an elective choice.

Furthermore, muni credit quality remains strong. Credit rating agency Moody’s found that only 0.08% of all muni bonds defaulted between 1970-2022. Plus, given the health of the broader economy and flush state reserve funds, it’s overwhelmingly positive on the quality front.

Source: National Association of State Budget Officers

Fund Flows Remain a Question Mark

One factor that still has the potential to veer from market averages is mutual fund flows.

If the masses determine that muni bonds are attractive, added buying pressure can effectively mute yields. Conversely, when outflows, or redemptions, are high, fund managers are frequently forced to exit quality bonds at a discount, which usually presents ideal buying opportunities for us.

To recap, 2022 was a year of excessive fund outflows, 2023 was more of a slow bleed and this year started with a very modest uptick in inflows. So, while we don’t anticipate a significant move one way or another, we’re attuned to shifts—and the potential repercussions in both directions.

Best Opportunities Largely Unchanged

With the fairly steady market outlook, the sectors most likely to offer an ideal blend of yield, quality, and accessibility continue to be general obligation bonds, issues tied to essential services, revenue bonds, and those issued by water and sewer utilities.

One area that warrants a fresh look is transportation, specifically airport bonds. Even through the worst of the pandemic, direct federal aid and relief funds for airlines kept bond payments current. And now with travel booming and the airports busy, it appears to be a sector that’s gaining strength.

Conversely, bonds issued by continuing care facilities, nursing homes, hospitals in rural areas or in highly competitive markets, and smaller colleges are generally best avoided due to less stable outlooks.

Geographically, Texas-based bonds continue to prove compelling because they’re generally high-quality, numerous issuers make for abundant supply, and without a state income tax, in-state demand is modest, which helps boost yields. Outside of that, much of the diversification in any given portfolio is driven by the state in which the investor is a taxpayer.

Our Firm Has Long Been Built Around SMAs

Unlike a “separate account,” a true SMA is customized to each investor and reflects their specific situation. It’s grounded in work that gets into the weeds on where they pay taxes, their risk appetite, their investment objectives, how muni bond exposure fits within their broader portfolio, and their time horizon.

Those are the conversations we have with advisors and clients. And the results of those discussions drive our bond-buying decisions, as we construct each customized portfolio.

Ultimately, by treating each investor uniquely and managing their investments separately, we believe the client sees the optima benefits from their municipal bond allocation.